Key points of kitchenware import and export trade

In todays globalized market environment, the import and export business of kitchenware holds tremendous business opportunities. For many enterprises involved in this field, how to navigate smoothly through complex international trade processes, ensure safe and efficient delivery of goods to their destinations, and achieve smooth capital recovery are crucial issues.

Professional documentation handling and logistics arrangements

- Document processing

- Documents in international trade are like passports, and their importance is self-evident. In the import and export business of kitchenware, commercial invoices are indispensable documents. They record key information such as product descriptions, quantities, and values in detail, serving as important bases for customs taxation and settlement between buyers and sellers. When preparing commercial invoices, it is essential to ensure the accuracy and completeness of information, including clear and error-free details such as product specifications, models, and brands.

- The bill of lading is also a core document. It not only serves as a receipt for goods, proving that the carrier has taken over the goods or loaded them onto the ship, but also as evidence of the transportation contract and a document of title. When handling bills of lading, special attention should be paid to the type of bill of lading, such as straight bills of lading, bearer bills of lading, and order bills of lading, each with its own characteristics. For goods like kitchenware, order bills of lading are usually recommended due to their higher flexibility and security, facilitating the transfer of title during transportation.

- The packing list is another document that cannot be overlooked. It details the contents of each package, aiding customs inspection and the consignees verification of goods. When preparing packing lists, ensure consistency with the information on commercial invoices and bills of lading, especially regarding the quantity and packaging specifications of the goods.

-

Logistics arrangement

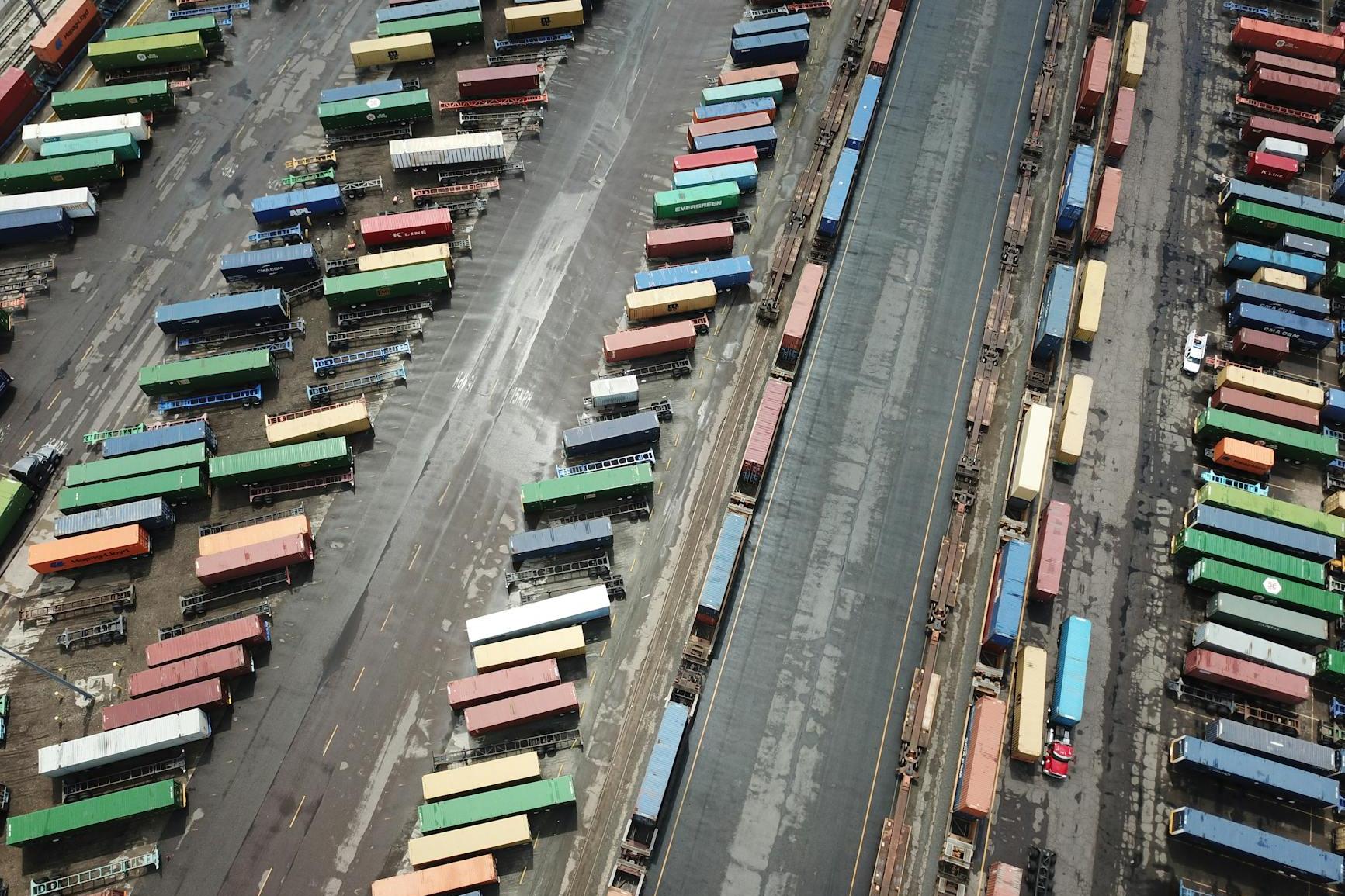

- Choosing the right transportation method is crucial for the import and export of kitchenware. Sea freight is the most common method, suitable for large quantities of kitchenware. When selecting sea freight, consider factors such as shipping schedules, freight costs, and the docking situation at the destination port. For example, different shipping companies have varying advantages on different routes; some excel in Southeast Asia routes, while others are more competitive in Russian routes.

- Air freight is suitable for high-value or urgently needed kitchenware. Although air freight costs are higher, the transportation speed is fast, meeting clients urgent time requirements. When arranging air freight, pay attention to the size and weight restrictions of the airlines cargo and the operational procedures at the airport.

-

Land transportation is also frequently used in trade with neighboring countries, such as border trade with Russia. Land transportation offers strong flexibility, but attention must be paid to the customs clearance requirements at border ports and the qualifications of transport vehicles.

-

During the logistics process, the packaging of goods should not be neglected. Most kitchenware items are fragile, such as ceramic tableware and glass kitchenware. Therefore, appropriate packaging materials, such as foam and bubble wrap, should be used for cushioning protection to ensure the goods are not damaged during transportation.

The Russian MarketUnique Advantages - Convenient VTB Settlement

- Overview of the Settlement Process

- Foreign exchange settlement is a crucial step in international trade, as it determines whether a company can successfully receive payment. In the export of kitchenware to Russia, conducting foreign exchange settlement through VTB (Vneshtorgbank) offers significant advantages. Typically, once the goods arrive at a Russian port and clear customs, the Russian importer will transfer the payment to their account at VTB Bank.

- After receiving the payment notice from the Russian party, the exporter needs to submit relevant documents to their bank, such as commercial invoices, bills of lading, and packing lists, to prove that the goods have been delivered as per the contract requirements. After verifying the documents, the bank will convert the foreign exchange into RMB at the current exchange rate and pay it to the exporter, completing the settlement process.

- VTB Settlement Advantages

- VTB Bank holds an important position in the Russian financial system and has close business ties with numerous Russian enterprises. Settling through VTB can accelerate the speed of fund arrival. Compared to other banks, VTB is more efficient in handling trade settlement transactions, usually completing fund transfers in a shorter time, enabling export enterprises to recover funds faster and improve capital utilization efficiency.

- Additionally, VTB Bank is relatively flexible in reviewing trade backgrounds. Under compliance, for transactions with minor document flaws due to special circumstances, VTB can handle them more leniently, reducing the risk of payment collection issues for export enterprises due to document problems. This is undoubtedly an important safeguard for kitchenware export enterprises, allowing smoother business operations with Russian clients.

Southeast Asian MarketsImport and export processand Solutions

- The settlement process typically involves: After completing exports and submitting required documents, enterprises apply for settlement. VTB Bank reviews documents and, upon confirmation, exchanges foreign currency into RMB at current rates. Compared to other banks, VTB has broader Russian market coverage and deeper understanding of local trade regulations and financial policies, enabling faster, more accurate settlement processing.

- Market research and customer developmentBefore importing kitchenware into the Southeast Asian market, conduct thorough market research. Understand the consumption habits, market demands, and competitive landscape of different Southeast Asian countries. For example, countries like Malaysia and Singapore have a certain demand for Western-style kitchenware, while Thailand and Vietnam prefer traditional kitchenware with local characteristics. Find suitable suppliers through international exhibitions, online platforms, and other channels, and establish contact with them.

- Contract SigningNegotiate with suppliers on terms such as product quality, quantity, price, delivery time, and payment methods. After reaching an agreement, sign a formal import contract. The contract should clearly define the rights and obligations of both parties, especially the inspection standards for product quality and dispute resolution methods, to avoid potential future disputes.

- Opening a Letter of Credit (if required)If the payment method is a letter of credit, the importer needs to apply to the bank to open a letter of credit within the time specified in the contract. After reviewing the importers qualifications and contract terms, the bank will issue the letter of credit to the exporter. A letter of credit is a form of bank credit that ensures the exporter receives payment when the terms of the letter of credit are met, while also guaranteeing the importer receives the goods as per the contract requirements. When opening a letter of credit, carefully review its terms to ensure they match the contract terms and avoid soft clauses that could pose risks to the importer.

- Transportation and InsuranceArrange transportation for the goods based on their characteristics and delivery time. At the same time, purchase transportation insurance to cover losses caused by natural disasters, accidents, or other reasons during transit. The insurance amount is generally calculated based on the CIF (cost, insurance, and freight) value of the goods plus a certain percentage.

- Customs clearanceAfter the goods arrive at the destination port, the importer needs to entrust a local customs broker to handle customs clearance procedures. The customs broker will declare detailed information about the goods to customs based on the HS code (commodity code), including the name, quantity, value, and origin of the goods. After verifying the declaration information, customs will levy the corresponding tariffs, VAT, and other taxes before releasing the goods. During customs clearance, ensure accurate documentation to avoid delays or penalties due to discrepancies or false declarations.

- Export Process

- Order ConfirmationAfter receiving an order from a Southeast Asian client, carefully review the order content, including key terms such as product specifications, quantity, price, and delivery time. If there are any questions, promptly communicate with the client to ensure mutual agreement on the order details.

- Production and stockingArrange production or procurement of goods according to the order requirements. During production, strictly control product quality and adhere to the clients standards. At the same time, plan the production schedule reasonably to ensure timely delivery.

- Booking Shipping Space and Customs DeclarationBased on the quantity and delivery time of the goods, book shipping space with the shipping company or freight forwarder. When booking space, provide accurate cargo information, including weight, volume, and packaging form. Prepare the necessary documents for customs clearance, such as commercial invoices, packing lists, customs declarations, and verification forms (if required), and entrust the customs broker to declare the goods to customs. After verifying the documents, the customs broker will enter the cargo information into the customs system, and customs will inspect the goods before releasing them.

- Loading and Bill of Lading IssuanceAfter customs releases the goods, arrange for loading onto the ship. Once loading is complete, the shipping company or freight forwarder will issue the bill of lading. Upon receiving the bill of lading, the exporter should carefully verify its information to ensure it matches the order and customs declaration details.

- Document Submission and SettlementThe exporter submits the bill of lading, commercial invoice, packing list, and other documents to the bank for settlement according to the payment method agreed in the contract. If the payment method is T/T (telegraphic transfer), the importer will directly transfer the payment to the exporters bank account after receiving the shipment notice. If the payment method is a letter of credit, the bank will pay according to the letter of credit terms after verifying the documents.

- The solution

- Cultural DifferencesSoutheast Asia is culturally diverse, with significant variations in business practices and cultural differences across different countries and regions. To better conduct business, enterprises can enhance their understanding and research of local cultures and train business personnel familiar with the local market. During communication and negotiations with clients, respect local cultural customs to avoid misunderstandings due to cultural differences.

- Changes in Trade PoliciesTrade policies in Southeast Asian countries are subject to frequent adjustments. Enterprises must closely monitor local policy developments and stay updated on changes in tariffs, quotas, certifications, etc. They can subscribe to professional trade information platforms or participate in industry association events to obtain the latest policy information, enabling timely business strategy adjustments to mitigate policy risks.

Zongdaifus professional document processing capabilities

- challenge

- Rise of Trade ProtectionismIn recent years, global trade protectionism has become increasingly evident. To protect domestic industries, many countries have introduced various trade restrictions, such as raising tariffs and implementing non-tariff barriers. For kitchenware import and export enterprises, this undoubtedly increases trade costs and risks. For example, some countries impose strict quality standards and certification requirements on imported kitchenware, requiring enterprises to invest significant time and resources to meet these requirements; otherwise, goods may be barred from entering the market.

- Exchange rate fluctuationsExchange rate instability poses significant challenges to foreign trade enterprises. Kitchenware import and export transactions typically involve long cycles, during which exchange rates may fluctuate substantially. If exchange rates move unfavorably, enterprise profits may be severely impacted. For instance, RMB appreciation could reduce export earnings, while importers may face higher procurement costs.

- Rising Logistics CostsDue to global oil price fluctuations, port congestion, and other factors, logistics costs continue to rise. Freight rates for sea, air, and land transport are persistently increasing. For the price-competitive kitchenware industry, this raises total product costs and weakens market competitiveness.

- Opportunities

- Emerging Market GrowthWith global economic development, consumer purchasing power in emerging markets is improving, driving growing demand for kitchenware. Beyond Russia and Southeast Asia, markets in Africa and South America are showing potential. These emerging markets offer kitchenware enterprises broader growth opportunities, enabling market risk diversification and new profit avenues.

- Development of e-commerce platformsThe rapid development of internet technology has spurred the rise of cross-border e-commerce platforms. Through these platforms, kitchenware enterprises can directly reach global consumers, breaking geographical barriers and reducing marketing costs. Additionally, big data analytics tools provided by e-commerce platforms help enterprises better understand consumer needs, precisely target markets, and launch demand-aligned products.

- Growing demand for green and eco-friendly productsConsumers are increasingly prioritizing environmental and health concerns, driving demand for eco-friendly kitchenware. Enterprises can seize this opportunity by increasing R&D investment to develop environmentally friendly and energy-efficient kitchenware, meeting market demands and enhancing competitiveness.

Relevant information on product certification services

In kitchenware import and export, product certification is a critical step. Different countries and regions have varying certification requirements. For example, kitchenware exported to the EU typically requires CE certification to demonstrate compliance with relevant EU directives and harmonized standards. CE certification covers product safety, environmental protection, and other aspects, requiring enterprises to conduct product testing and audits as per certification body requirements.

Kitchenware exported to the U.S. may require FDA (U.S. Food and Drug Administration) certification to ensure food contact safety. In Russia, some kitchenware products may need GOST certification.

While our company does not directly provide certification services, we inform clients of required certifications and assist in the process. Leveraging extensive industry experience, we help clients understand certification procedures, prepare documentation, and communicate effectively with certification bodies to ensure smooth certification. This enables clients to navigate complex certification requirements with confidence, reducing risks and costs.

In summary, kitchenware import and export present both opportunities and challenges. Enterprises must leverage their strengths, deepen understanding of documentation, logistics, market characteristics, and certification requirements, while closely monitoring international trade developments to succeed in a competitive market.

Follow Customer Service WeChat

Follow Customer Service WeChat